Lam Research: Essential Partner For Chip Manufacturing

Lam Research Corporation (LRCX) is a leading provider of wafer fabrication equipment for the semiconductor industry.

Changelog:

Jan 30, 2025: Updated fair price valuation. The new fair price is $88.

Jan 14, 2025: Overview: Share Repurchase Program, Management Changes, Challenges from Key Customers, Positive Market Outlook, and Increased Focus on AI Demand.

Nov 01, 2024: Updated fair price valuation: $102.71.

Lam Research Corporation (LRCX) is a leading provider of wafer fabrication equipment for the semiconductor industry. With strong relationships with major players like Samsung, TSMC, and Micron, Lam Research has established itself as an essential partner in chip manufacturing. Its expertise in both etch and deposition processes allows it to offer comprehensive solutions to chipmakers. The company holds a strong balance sheet and generates substantial cash flow.

Previous publication:

Content:

💡 Investment Thesis

🧐 Company Overview

🏰 Economic Moat

🚀 Business Strategy

✅ Advantages

❌ Disadvantages

🏛️ Capital Allocation

🥇 Competitors

📣 Recent News

⏮️ Past

📶 Future

💲Current Valuation

🏷️ Fair Price

☑️ Checklist

💡 Investment Thesis

LRCX's wide economic moat is very difficult to overcome (I would say even almost impossible), with only a few big players in this particular niche. A solid brand name that serves such names as Samsung, TSMC, Intel, and Micron. I believe their relationships will stay for a long term due to Lam Research's deep expertise and high switching costs.

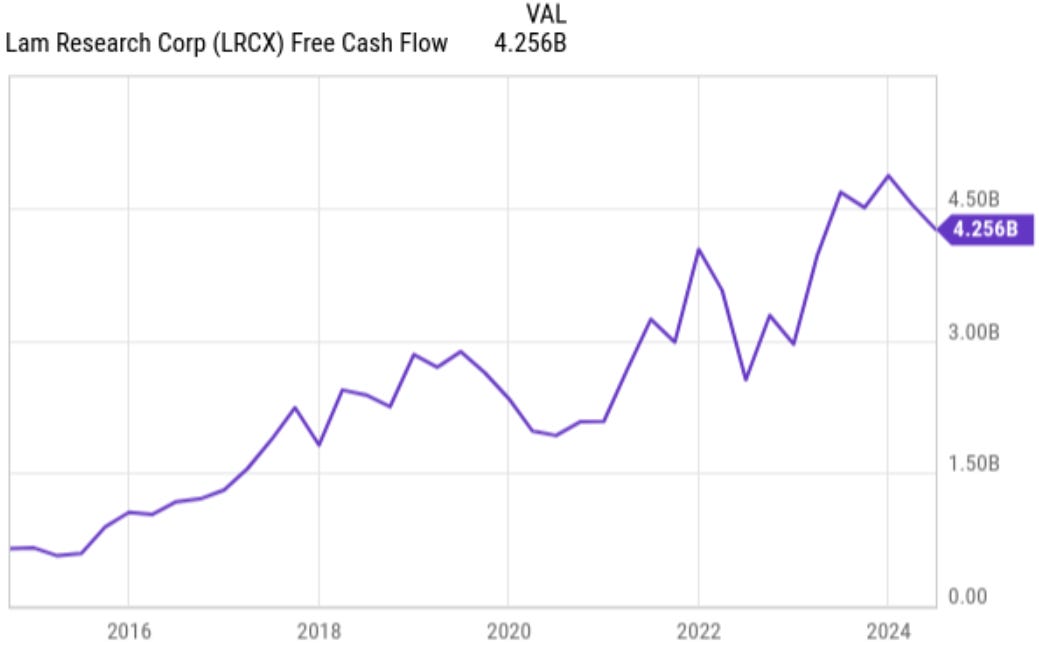

LR has extensive knowledge of semiconductor deposition and etch processes. Substantial investment in R&D allows Lam to build upon its huge base of intangible assets and stay ahead of technological advancements in semiconductor manufacturing. The company is generating strong cash flow and maintaining a solid balance sheet. Regular buybacks and increasing dividends; high ROIC, ROA, and ROE.

Among the disadvantages are cyclical downturns in this segment and geopolitical risks. Compared to its 5-year averages, currently trading with a premium; but, based on my Fair Price estimate, is undervalued by 11.68%. Other analysts are also positive-looking (almost +35% upside potential in the next 12 months).

🧐 Company Overview

Incorporated: 1980

Sector: Technology

Industry: Semiconductor Equipment & Materials

Stock Style: Large Core

Market Cap: $100.42 Bil

Earnings Date: Oct 16 - Oct 21, 2024Lam Research Corporation (LRCX) stands as one of the world's largest providers of wafer fabrication equipment for semiconductors. Founded in 1980.

The company specializes in deposition and etch processes, which are critical steps in semiconductor manufacturing. Lam Research holds a dominant market share in etch equipment, holding over one-third of the market, and maintains a strong second position in deposition equipment with approximately 20% market share. The company's customer base includes the largest chipmakers globally, such as TSMC, Samsung, Intel, and Micron. Lam Research's expertise in memory chip production, particularly for 3D NAND and DRAM technologies, has positioned it as a key player in the semiconductor equipment industry.

To Read: Company's history

🏰 Economic Moat

Lam Research has a wide economic moat - substantial intangible assets and high switching costs for customers. The company's excellent design expertise is the reason for their extensive knowledge in semiconductor deposition and etch processes. Lam's built-in business services and long-term customer roadmaps create sticky relationships with chipmakers.

An impressive barrier to entry exists due to the large investment required to stay at the front, which only allows the largest and best-capitalized chip equipment manufacturers to compete effectively.

🚀 Business Strategy

LRCX's business strategy is based on maintaining and expanding its market share through continuous innovation and investment in research and development. The company allocates nearly $2 billion annually to R&D, which outdoes all but the largest competitors in the wafer fabrication equipment industry. This substantial investment allows Lam to build upon its immense base of intangible assets and stay ahead of technological advancements in semiconductor manufacturing.

The company focuses on developing equipment for increasingly complex chip designs, including higher memory chip density, high-bandwidth memory for artificial intelligence applications, and advanced packaging technologies. Their strategy also involves deepening its relationships with key customers through long-term project roadmaps, sometimes extending up to 10 years into the future. This approach allows Lam to align its product development with customer requirements and secure future equipment placements.

Below is a list of LRCX's core business segments:

Etch. This segment focuses on equipment and technologies for etching patterns onto semiconductor wafers. Etching is a crucial step in semiconductor manufacturing that allows for the precise removal of materials to create integrated circuits. Lam Research is known for its advanced plasma etch technology that supports the production of complex semiconductor architectures.

To Read: Company's Processes

Deposition. In the deposition segment, Lam provides equipment for thin-film deposition processes. This includes Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD), which are essential for depositing layers of materials on semiconductor wafers. The company’s deposition technologies are vital for creating the various layers of materials needed in modern chips.

Cleaning. Lam Research also develops cleaning solutions for manufacturing environments. Cleaning semiconductor wafers is critical to ensure that they are free from contaminants to maintain product yield and performance. This segment includes technologies designed to remove unwanted materials without damaging the wafer.

Service and Support. This segment encompasses post-sale services to ensure optimal performance of Lam’s equipment. It includes maintenance, repairs, upgrades, and parts replacement. The service segment is important for ensuring customer satisfaction and loyalty, as well as providing recurring revenue streams.

Emerging Technologies. Lam Research is also exploring new technologies and innovations in semiconductor manufacturing processes, such as advancements in machine learning and automation that can enhance manufacturing efficiency and capabilities. This segment may also focus on next-generation semiconductor technologies, such as those used in 5G, artificial intelligence, and high-performance computing.

✅ Advantages

Strong market position, particularly in the memory chip segment. The company's equipment processes the majority of 3D NAND wafers produced worldwide - dominance in this critical area. The expertise in both etch and deposition processes allows it to offer comprehensive solutions to chipmakers, enhancing its value proposition.

The company's strong customer relationships, strengthened by on-site service engineers who work closely with chipmakers' teams - a significant competitive advantage. These engineers help calibrate equipment during R&D, troubleshoot during production, and assist in meeting manufacturing requirements, making Lam's solutions highly integrated and difficult to replace.

Lam's financial strength - the company is generating strong cash flow and maintaining a solid balance sheet. This financial stability allows it to invest heavily in R&D and return substantial capital to shareholders.

Lam has established long-term partnerships with major semiconductor manufacturers like Intel, Samsung, and TSMC. These relationships stimulate loyalty and make it difficult for competitors to penetrate these customers' operations.

The company operates worldwide, which gives it a broad market presence and the ability to provide localized support and service to its customers, enhancing customer satisfaction and operational efficiency.

A strong brand reputation thanks to being a pioneer in the semiconductor equipment field.

Focused on sustainability, developing technologies that reduce energy consumption and waste in semiconductor manufacturing.

❌ Disadvantages

The company's high exposure to the memory chip market makes it more vulnerable to cyclical downturns in this segment. For instance, in 2023, Lam experienced a significant sales decline of over 20% due to weakness in the memory market, particularly in NAND flash chips.

Geopolitical risks, primarily arise from tensions between the United States and China. Export restrictions on advanced semiconductor manufacturing equipment could potentially limit Lam's ability to ship to Chinese chipmakers, although the impact has been limited thus far.

The company's reliance on a concentrated customer base. If relationships with major manufacturers like TSMC, Samsung, or Micron were to deteriorate, it could significantly impact Lam's competitive position and financial performance.

🏛️ Capital Allocation

The company holds a strong balance sheet with low net debt and long-dated debt maturities. Lam generates substantial cash flow and has a target of returning at least 75% of free cash flow to shareholders, often exceeding this threshold.

The company prioritizes organic R&D investment, which has been crucial in establishing its wide economic moat and gaining market share in wafer fabrication equipment over the past five years. Lam has successfully expanded its presence with logic customers, helping to diversify its revenue base.

The company pays dividends and does regular buybacks.

While large acquisitions are unlikely due to antitrust concerns in the consolidated wafer fabrication equipment market, Lam occasionally makes small acquisitions to strengthen its software capabilities or add depth to specific chemical processes.

🥇 Competitors

Lam Research's primary competitors in the wafer fabrication equipment market include Applied Materials and KLA Corporation. Applied Materials is the largest player in the industry and poses the most significant competitive threat to Lam. While Lam leads in etch equipment, Applied Materials holds a stronger position in deposition equipment.

KLA Corporation specializes in process control and yield management systems. While not directly competing in etch and deposition, KLA's products are complementary and essential in the semiconductor manufacturing process.

The wafer fabrication equipment market is highly consolidated, with the top five suppliers, including Lam, accounting for over 70% of total revenue. This concentration limits the potential for new entrants and strengthens the competitive positions of established players.

Another non-US competitor worth noting is Tokyo Electron (Japan).

📣 Recent News

On Sep 10, 2024, LR broke ground on a Systems Lab in India. This new facility will be one of the most advanced semiconductor labs in the country and will allow LR's team members in India to validate engineering designs for next-generation DRAM, NAND, and logic devices.

Related Analysis:

On Aug 20 2024, LR’s Equipment Intelligence won Innovative Product of the Year in the AI/Machine Learning category.

On Mar 26, 2024, LR introduced a pulsed laser deposition system, namely, Pulsus, for next-generation MEMS-based microphones and RF filters, enabling enhanced performance and functionality.

⏮️ Past

LR reported strong Q2 2024 results, exceeding guidance with revenue at $3.87 billion and earnings per share at $8.14. The company's CSBG business grew 22%, contributing significantly to its performance. The Malaysia factory achieved a milestone by shipping its 5,000th chamber. For the next quarter, Lam anticipates revenue of $4.05 billion and a gross margin of around 47%. They expect continued growth, driven by AI advancements and WFE spending, which is forecasted to be around $90 billion for 2024. Strategic investments in product development and operational efficiency are seen positioning Lam for long-term success, particularly in expanding markets like AI and advanced semiconductor technologies.

As we can see, LR has outperformed the industry and the S&P 500 for three, five, ten, and fifteen years (CAGR).

📶 Future

The company is expected to see strong growth over the next few fiscal years. Sales are projected to increase from $17.48 billion in FY 2025 to $22.37 billion in FY 2027, representing a compound annual growth rate (CAGR) of about 13.1%. Earnings per share (EPS) are forecast to grow even more rapidly, from $35.80 in FY 2025 to $50.65 in FY 2027, implying a CAGR of approximately 18.9%. This suggests the company is expected to improve its profitability and margins over this period.

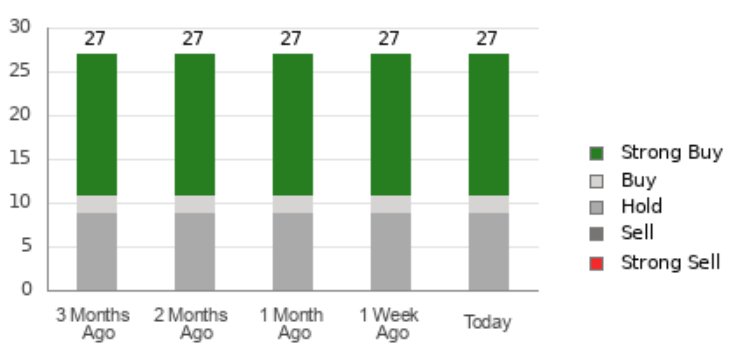

The average price target of $1,040.92 represents a substantial 34.63% upside potential. The most optimistic target suggests a potential upside of 71.37%, while even the lowest target implies only a modest 3% downside risk. This distribution of price targets indicates that analysts generally expect significant appreciation in the stock price, with limited downside risk.

The analyst recommendations show a very bullish sentiment towards the stock. Out of 27 analysts covering the company, a significant majority rate it as a "Strong Buy" or "Buy". This positive outlook has remained consistent over the past three months, indicating sustained confidence in the company's prospects. The lack of any "Sell" or "Strong Sell" recommendations further underscores the optimistic view among other analysts.

According to Mordor Intelligence, the semiconductor etch equipment market is expected to grow from USD 23.80 Billion in 2024 to USD 34.32 Billion in 2029. The Compound Annual Growth Rate (CAGR) from 2024 to 2029 is projected to be 7.60%. Asia-Pacific is both the fastest-growing and largest market for semiconductor etch equipment. Lam remains well-poised to capitalize on these prospects.

💲Current Valuation

The current LR's valuation is higher than its 5-year averages; all metrics. In addition, to be honest, I don't like a relatively (to previous years) high PEG ratio. In this case, I would say it's not the proper time for entrance but we should keep a close look at any drawdown for such a great company. Also, LRCX is currently trading more expensive than AMAT (see the table above), but cheaper than KLAC. But my Fair Price estimate is below the current valuation (see the next section).

🏷️ Fair Price

Jan 30, 2025: Updated fair price valuation. The new fair price is $288.

The Long-Term Pick's Fair Price (Base Case) for LRCX is $886.50. The current price of $782.91 is lower by 11.68%.

Fair-to-Current Price (%): 11.68%

Current Price/Fair Price: 0.88

I used:

Discount Rate: 12% (S&P 500 Next 5-Yr Growth Estimates is 12.04%)

Margin of Safety: 30%

Years: 10

Future EPS Growth Rate: 11%

Future Dividend and Buyback Yield: 4%

Total Future Annual Growth Rate: 11 + 4 = 15%

For the Future Dividend and Buyback Yield, I took 4% since the company has been regularly increasing dividend yield and going to do this in the future (3-year dividend growth rate: 15.4), and the 3-year average share buyback ratio is 3.

For the Base Case, the Future Expit P/E is 19. 5-Yr average P/E ratio is 19.87, the lowest P/E during the last ten years was 10.30 in 2018, and the highest was 26.82 in 2020. For the Bear Case, the Future Exit P/E is 15 due to cyclical downturns in this segment.

As I already wrote, there are cyclical downturns in the industry. That's why it's better to sell the stock during years of high performance.

☑️ Checklist

Profitability:

✅ Gross margin at least 40%: 48%

✅ Net margin at least 10%: 26%

✅ Management (ROIC, ROCE, ROE, ROA): Yes (All above 10%)

❌ Piotroski F-Score: 6 of 9 (Not passed: Higher ROA YoY, Higher Current Ratio YoY, Higher Asset Turnover YoY)

✅ Revenue surprises in last 7 years: Yes (Based on TradingView's data)

✅ EPS surprises in last 7 years: Yes (Based on TradingView's data)

❌ EPS growth YoY 10 years: No (Declines in 2019 and 2024)

Valuation and Advantage:

❌ Valuation below its 5-yr average: No

✅ Does it have a moat: Yes (wide)

Shares:

❌ Insider ownership at least 5%: No (0.3%)

✅ Less shares outstanding YoY: Yes

✅ Insider buys last six months: Yes (Ava A. Harter, Chief Legal Officer, 8.71k shares)

Price:

✅ 1-year stock price forecast is above 10%: +34.63%

❌ Next 5-Yr CAGR is above S&P 500: No (11% vs 12%)

❌ DCF Value: $784.32 (Fairly valued; 10 years, discount rate: 10%, terminal growth: 3%, equity model: FCFE)

✅ Short Interest below 5%: Yes (1.98%)

This is not a financial or investing recommendation. It is solely for educational purposes.

Really like your stile of writing, straight to the point, very interesting. good job, thank you!

Thanks for sharing your analysis. It's a great addition to the watch list. In my personal portfolio, I have added at these prices