Applied Materials: Largest Wafer Fabrication Equipment Supplier

Applied Materials is a key player in the semiconductor equipment industry, driven by its innovative technologies and strong focus on producing advanced chips for growing industries.

Changelog:

Feb 28: Updated fair price valuation: $187.

Applied Materials (AMAT) is a leading player in the semiconductor equipment industry, providing essential tools and services for the production of advanced chips used in a wide range of technologies, including artificial intelligence, data centers, and automotive. The company focuses on innovation and expanding its product offerings, allowing it to maintain a strong position in a highly competitive market. With a diversified business model that spans semiconductor manufacturing, display technologies, and solar solutions, Applied Materials is well-positioned to continue benefiting from the growing demand for advanced chips and emerging technologies in the years ahead.

Content:

💡 Investment Thesis

🤔 Why is Applied Materials down this year?

🧐 Company Overview

🏰 Economic Moat

🚀 Business Strategy

🏛️ Capital Allocation

✅ Advantages

❌ Disadvantages

🥇 Competitors

⏮️ Past

📶 Future

💲Current Valuation

🏷️ Fair Price

☑️ Checklist

✍️ Due Diligence

💡 Investment Thesis

Applied Materials is a key player in semiconductor manufacturing equipment, benefiting from the growing demand for advanced chips used in AI, data centers, and automotive technologies. Under CEO Gary Dickerson’s leadership, the company has focused on expanding its product portfolio and maintaining strong customer relationships.

AMAT’s financial health is solid, with strong revenue growth driven by its diversified operations. The company is geographically balanced, generating 30% of its revenue from China and maintaining a strong presence in the U.S. and Europe. Diversification across business segments adds to its resilience.

Compared to its competitors, Lam Research and KLA, Applied Materials trades at the lowest valuation. The stock is priced near its 5-year averages, providing a favorable entry point for investors.

➡️ Applied Materials: Quick Analysis, Market Overview, and Comparison With Competitors (Additional materials)

🤔 Why is Applied Materials down this year?

Applied Materials' stock has declined this year due to several key factors. One major issue is the cyclical downturn in the semiconductor market, particularly affecting DRAM and memory sectors, leading to sluggish capital expenditures and unfavorable pricing trends.

Additionally, geopolitical tensions related to U.S.-China trade relations have raised concerns about future growth, especially with ongoing restrictions on technology exports to China. The broader economic environment, marked by inflation and high interest rates, has further pressured AMAT's stock.

Negative sentiment from competitors in the semiconductor space also plays a role. Recent earnings reports from companies like Lam Research have increased fears of reduced spending across the industry.

🧐 Company Overview

Incorporated: 1967

IPO: 1972

Sector: Technology

Industry: Semiconductor Equipment & Materials

Stock Style: Large Core

Market Cap: $143.88 Bil

Total Number of Employees: 34,000

Website: https://www.appliedmaterials.com/

Earnings Date: Feb 13 - Feb 17, 2025Applied Materials, headquartered in Santa Clara, California, is the world’s largest supplier of wafer fabrication equipment. It also plays a significant role in manufacturing displays for consumer electronics and solar panels. The company serves industries that are essential to modern life, including automotive, artificial intelligence, and renewable energy. Applied operates across three main business areas: Semiconductor Systems, Applied Global Services, and Display and Adjacent Markets.

Applied’s Semiconductor Systems division remains its primary source of income, contributing more than 70% of revenue. Meanwhile, the Applied Global Services division provides recurring income through system maintenance and upgrades, ensuring stability even during industry downturns. With over 33,000 systems installed worldwide, the company’s reach extends to key markets in Asia, North America, and Europe.

Gary Dickerson has been AMAT’s CEO since September 2013 and has been recognized by multiple organizations as a top-performing CEO (Barron’s, Forbes and the Harvard Business Review). He has more than 35 years of semiconductor experience. Before Applied Materials, he was CEO of Varian Semiconductor Equipment Associates for seven years, until its acquisition by Applied Materials in 2011, and spent 18 years at KLA-Tencor Corporation (competitor; see the section Competitors below) where he held a variety of operations and product development roles before serving as president and chief operating officer.

Related Publication:

🏰 Economic Moat

Applied Materials has a wide economic moat, supported by its advanced technology, high customer loyalty, and significant investment in R&D. Its products are essential to chipmakers that rely on its precision tools to create semiconductors. Switching costs are extremely high for customers, as replacing Applied’s equipment would require changes in manufacturing processes, additional training, and potential redesigns of their products.

The company develops technologies that address the growing complexity of semiconductors, such as gate-all-around transistors and high-bandwidth memory. It also offers long-term customer support through its service engineers, who work directly with clients to ensure optimal performance of their systems. These factors create lasting customer relationships.

🚀 Business Strategy

The company provides solutions for every step of the semiconductor manufacturing process, including deposition, etching, and process control. By offering integrated systems that combine multiple functions, Applied helps customers save time, reduce costs, and improve efficiency.

The company also targets growth areas such as artificial intelligence, automotive technologies, and renewable energy. These industries increasingly require more advanced chips, and Applied’s tools enable their production. Additionally, the Applied Global Services division ensures steady revenue by offering maintenance, optimization, and upgrade services for its installed base of systems.

This diversification of income helps the company overcome cyclical downturns in equipment sales. Its global presence allows it to capitalize on growing semiconductor demand in different regions.

Core business segments:

Semiconductor Systems: This segment provides equipment used in the manufacture of semiconductors. It includes technology for the fabrication of integrated circuits (ICs), including etching, deposition, ion implantation, and metrology systems. The semiconductor sector is the largest revenue contributor for Applied Materials and supports advancements in chip design and production processes.

Applied Global Services: This segment offers a range of services that enhance the performance and productivity of manufacturing equipment. It includes the maintenance, optimization, and upgrade of tools to improve efficiencies in semiconductor and display manufacturing, helping clients maintain their production lines with minimal downtime.

Display and Adjacent Markets: This segment focuses on equipment and technologies used in the production of display panels, such as LCD and OLED. It encompasses technologies related to the manufacture of flat-panel displays, which are essential for TVs, smartphones, and other electronic devices.

Solar: Applied Materials has also been involved in the solar energy market, providing equipment for photovoltaic cell manufacturing. Although this segment has seen fluctuations due to changes in market demand, it is a growing area focused on renewable energy solutions.

Vision: More recently, the company has expanded its capabilities into areas related to advanced technologies, including AI, machine learning, and robotics, which serve various markets beyond semiconductors.

🏛️ Capital Allocation

I see Applied Materials’ capital allocation strategy as a combined approach of balance and efficiency. The company consistently generates strong free cash flow (see chart above), allocating over 80% of it to shareholder returns through dividends and buybacks. It has increased its dividend every year since 2018.

At the same time, Applied invests heavily in R&D (see the chart below) to maintain its leadership in the semiconductor industry. While large acquisitions are rare due to regulatory concerns, the company makes smaller, strategic purchases to enhance its product offerings.

This careful allocation of resources ensures that Applied remains financially stable while driving innovation and growth.

✅ Advantages

Industry Leadership. AMAT is the top supplier of semiconductor equipment worldwide. Its strong position in deposition and process control markets guarantees it remains essential to chipmakers.

High R&D Spending. The company spends over $3 billion annually on research and development, more than most of its competitors. This allows it to stay ahead in the rapidly evolving semiconductor industry, developing innovations that meet the increasing complexity of modern chips.

Global Reach. AMAT operates across all major semiconductor markets, including a significant presence in China, which accounts for almost 30% of its revenue. This geographical diversity allows it to tap into regional growth opportunities while reducing risks associated with dependence on any single market.

Strong Recurring Revenue. The Applied Global Services division contributes almost 22% of the company’s revenue through maintenance, upgrades, and lifecycle services for its installed systems. This provides steady income that balances the cyclicality of its core equipment business.

Broad Product Portfolio. The company's offerings cover semiconductors, displays, and solar energy, allowing it to receive revenue from various industries. Its leadership in technologies like DRAM and NAND further supports its ability to adapt to changing market needs.

❌ Disadvantages

Customer Dependence. A significant portion of Applied’s revenue comes from a few large clients, such as TSMC, Samsung, and Intel. This dependence increases risk, as losing a major customer could severely impact the company’s financial performance.

Industry Cyclicality. The semiconductor industry experiences periods of high demand followed by downturns. This cyclicality can lead to unpredictable revenue and put pressure on the company’s margins during weaker cycles.

High Operating Costs. Applied’s fixed-cost structure makes it vulnerable during periods of reduced sales. Maintaining its operations and innovation efforts requires consistent revenue, which can be challenging in a cyclical market.

Geopolitical Risks. Export restrictions, especially between the U.S. and China, present a significant threat to the company. Further restrictions could limit its ability to serve one of its largest markets.

🥇 Competitors

Applied Materials competes with Lam Research and KLA, both of which are leaders in specific areas of semiconductor manufacturing.

Pay attention AMAT is currently trading at the cheapes level among its competitors (see my screenshots above).

Lam Research focuses on etch and deposition technologies, delivering precision tools that are essential for advanced chipmaking. While Lam excels in these areas, Applied’s broader portfolio allows it to serve customers with integrated solutions that address multiple steps in the manufacturing process.

KLA is the market leader in process control, providing tools for inspecting and improving the quality of semiconductor manufacturing. Applied competes in this segment but differentiates itself through its ability to serve other markets, such as deposition and etching. This broader focus allows Applied to generate revenue from diverse sources and offer more value to clients.

Although Lam Research and KLA are notable competitors, Applied’s strength lies in its integration of services and products.

⏮️ Past

On 14th November, the company concluded fiscal 2024 with record revenue of $27.18 billion, a 2% increase year-over-year, while maintaining a gross margin of 47.6%. In Q4, earnings per share hit $2.32, up 9% year-over-year. The China revenue mix stabilized at 30% as expected, impacting the semiconductor segment with a 6% growth.

Above is the compound annual growth rate (CAGR) for the AMAT stock over 5-year, 10-year, and 15-year time periods. The 5-year CAGR is 26.15%, the 10-year CAGR is 23.81%, and the 15-year CAGR is 21.19%. All periods are outperforming the S&P 500.

Above is a comparison of total returns with the S&P 500 (VOO) on a 10-year period.

Latest important news:

November 2024: AMAT introduced the MAX OLED™ solution, a patented OLED pixel architecture and revolutionary display manufacturing technology designed to bring the superior OLED displays found in high-end smartphones to tablets, PCs and eventually TVs.

June 2024: the company released its latest Sustainability Report, showcasing significant progress towards its Net Zero 2040 goals. The report highlighted initiatives aimed at reducing carbon emissions across the semiconductor supply chain and emphasized the company's commitment to renewable energy sourcing.

April 2024: Applied Materials announced its acquisition of Aselta Nanographics, enhancing its metrology solutions for semiconductor manufacturing. This acquisition aims to improve design-based metrology capabilities, which are critical for ensuring precision in advanced chip production.

Mar 2024: AMAT earned Intel’s EPIC Distinguished Supplier Award through its dedication to Excellence, Partnership, Inclusion and Continuous (EPIC) quality improvement.

Feb 2024: Applied Materials introduced new products like Sym3 Y Magnum etch system and Producer XP Pioneer CVD (chemical vapor deposition) patterning film, to address chip patterning needs in the "angstrom era" by utilizing new materials engineering and metrology techniques.

Jan 9, 2024: The company announced it is collaborating with Google on advanced technologies for augmented reality (AR).

📶 Future

Looking ahead, Q1 guidance forecasts revenues of $7.15 billion, with an EPS of $2.29, both up 7%. Growth in the advanced node market is anticipated, aiming to double equipment shipments to gate-all-around nodes to approximately $5 billion in 2025.

Sales are projected to grow steadily, from $29.64 billion in FY 2025 to $32.14 billion in FY 2026 and $34.01 billion in FY 2027. EPS is also expected to grow, from $9.55 in FY 2025 to $10.78 in FY 2026 and $11.94 in FY 2027.

Based on 1-year price targets offered by 28 analysts, the average price target for Applied Materials comes to $222.78. The forecasts range from a low of $155.00 to a high of $260.00. The average price target represents an increase of 28.63%.

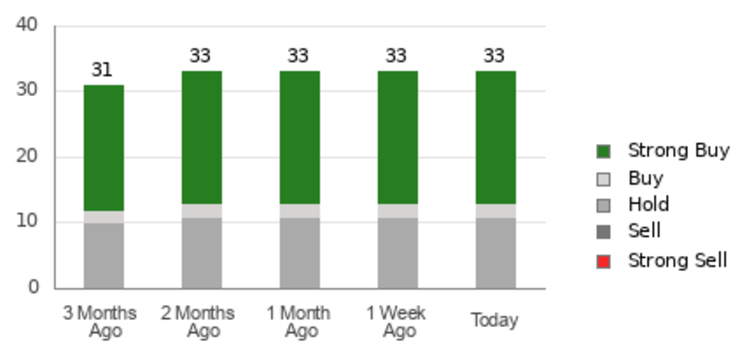

AMAT currently has an average brokerage recommendation (ABR) of 1.73 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations made by 33 brokerage firms. The current ABR compares to an ABR of 1.73 a month ago based on 33 recommendations.

💲Current Valuation

Currently, the company trades below its 5-year averages for Price/FCF and the PEG ratio.

If we look at the Price/Sales, Price/Earnings and Price/Forward Earnings ratios, we will find that the company is trading close to its 5-year average values.

🏷️ Fair Price

The Long-Term Pick's Fair Price (Base Case) for AMAT is $217.76. The current price of $174.71 is lower by 19.77%.

Fair-to-Current Price (%): 19.77%

Current Price/Fair Price: 0.80

I used:

Discount Rate: 12% (S&P 500 Next 5-Yr Growth Estimates is 11.05%)

Margin of Safety: 30%

Years: 5

Future EPS Growth Rate: 12% (The next 5-year EPS growth forecast is 12.30% annualized)

Future Dividend and Buyback Yield: 3% (I took the 5-year average value which is 3.17%)

Total Future Annual Growth Rate: 12 + 3 = 15%

Review the historical long-term CAGR results (the Past section) - I find my "modest" 15% achievable.

You are reading this analysis for free, but conducting such research requires a significant amount of time. Consider supporting the author on Patreon. Your support is greatly appreciated and enables a greater focus on creating even better content.

☑️ Checklist

Profitability:

✅ Gross margin at least 40%: 47%

✅ Net margin at least 10%: 26%

✅ Management (ROIC, ROCE, ROE, ROA): Yes (All above 10%)

🟨 Piotroski F-Score: 6 of 9 (Not passed: Higher ROA yoy, Higher Current Ratio yoy, Higher Asset Turnover yoy)

❌ Revenue surprises in last 7 years: No (2021; Based on TradingView's data)

❌ EPS surprises in last 7 years: No (2021; Based on TradingView's data)

❌ EPS growth YoY 7 years in a row: No (2019; Based on TradingView's data)

Valuation and Advantage:

🟨 Valuation below its 5-yr average: No (Trading close to 5-year averages)

✅ Does it have a moat: Yes (wide)

Shares:

❌ Insider ownership at least 5%: No (0.30%)

✅ Less shares outstanding YoY: Yes

❌ Insider buys last six months: No

Price:

✅ 1-year stock price forecast is above 10%: +28.63%

✅ Next 5-Yr Growth Estimates (CAGR) is above S&P 500: Yes (12.30% vs 11.05%; Based on Koyfin)

❌ DCF Value: $143.34; Overvalued by 19% (5 years, discount rate: 10%, terminal growth: 3%, equity model: FCFF)

✅ Short Interest below 5%: Yes (2.03%)

✍️ Due Diligence

Profitability (7.5 of 10):

✅ Positive Gross Profit: $12.9B (for the last twelve months)

✅ Positive Operating Income: $7.9B (for the last twelve months)

✅ Positive Net Income: $7.2B (for the last twelve months)

✅ Positive Free Cash Flow: $7.5B (for the last twelve months)

⚠️ Positive 1-Year Revenue Growth: 2% (over the past 12 months)

⚠️ Positive 3-Year Revenue Growth: 6% (for the last 3 years)

⚠️ Positive Revenue Growth Forecast: 8% (over the next 3 years)

✅ Exceptional ROE: 42% (for the past 12 months)

✅ Exceptional 3-Year Average ROE: 50%

❌ ROE is Declining: 52% → 42% (in the last 3 years)

✅ Exceptional ROIC: 33% (for the past 12 months)

✅ Exceptional 3-Year Average ROIC: 34%

❌ ROIC is Declining: 36% → 33% (in the last 3 years)

Solvency (9 of 10):

✅ High Interest Coverage: 38.38 (earns more than enough operating income (8B USD) to safely cover interest payments on its debt (205m USD))

✅ Short-Term Solvency (short-term assets (21B USD) exceed its short-term liabilties (8B USD))

✅ Long-Term Solvency (long-term assets (34B USD) exceed its long-term liabilties (15B USD))

✅ Negative Net Debt: -$3.2B (the company has more cash and short-term investments (9B USD) than debt (6B USD))

✅ Low D/E: 0.33

✅ High Altman Z-Score: 7.67

This is not a financial or investing recommendation. It is solely for educational purposes.

Thanks Dan! Looks like a solid piece of work. Heads I win, tails I don't lose much kind of scenario.

thanks. an interesting chart with money in/out flows. didn't see Japan - this country has a huge us assets holding