🛡️ Fortinet, constant evolution, and the cybersecurity landscape. FTNT Stock Analysis

For my second stock analysis, I'm interested in Fortinet (FTNT), a prominent player in the cybersecurity industry.

Changelog:

Feb 12, 2025: Updated fair price valuation: $78.

Jan 24, 2025: Overview: Share Repurchase Program, Acquisition of Perception Point, FortiGate Rugged 70G, Key Growth Areas, Partnership With Google Cloud, Launch of FortiAppSec Cloud, and Latest Version of FortiOS.

Nov 19, 2024: Updated fair price valuation: $94.88.

The company provides a wide range of solutions including network security, cloud security, zero-trust access, and security operations. However, it operates in a highly competitive cybersecurity market. So, let's delve deeper into the company and analyze it.

🧐 Company Overview

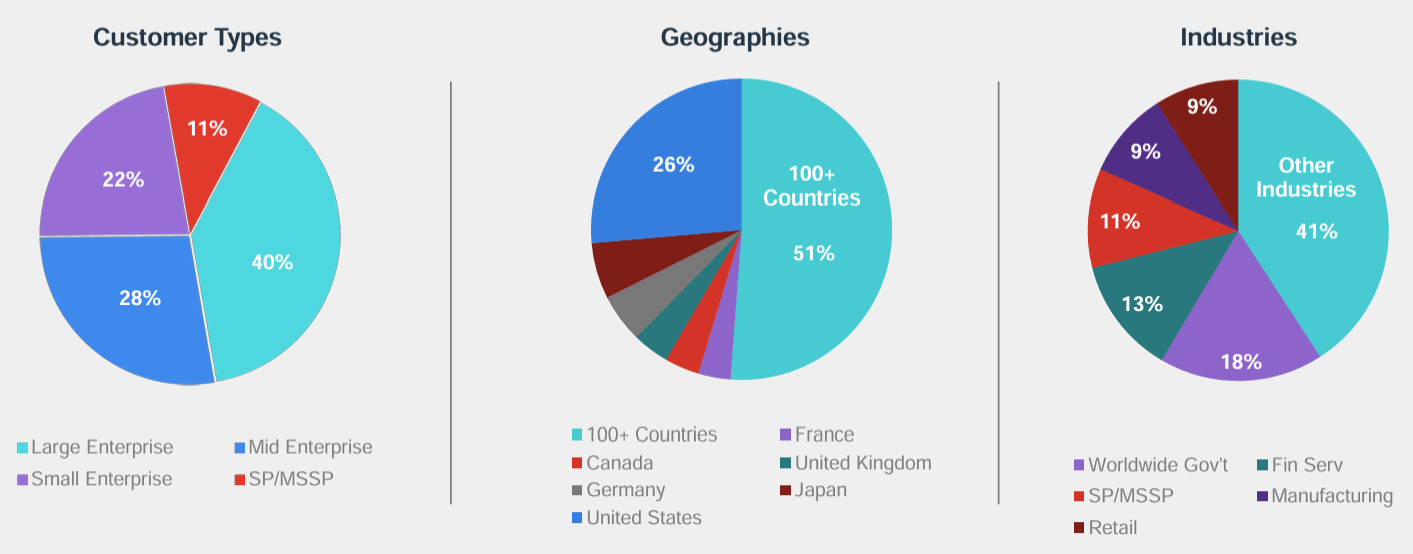

Founded in 2000 by current CEO Ken Xie and his brother, president and CTO Michael Xie, Fortinet has established itself as a leader in the cybersecurity space. The company offers a comprehensive suite of solutions spanning network security, cloud security, zero-trust access, and security operations. Fortinet's flagship offering is its next-generation firewall technology, which forms the cornerstone of its security fabric platform. This platform encompasses a wide range of modules including network security, endpoint protection, and cloud security solutions. The company's product portfolio is complemented by its FortiGuard threat detection and prevention service and FortiCare support offerings, which provide ongoing protection and assistance to its vast customer base of more than 700,000 clients worldwide.

📰 To read: Learn more about Fortinet and the Security Fabric

Fortinet's approach to cybersecurity is characterized by its emphasis on providing integrated, platform-based solutions that address the complex and evolving threat landscape faced by modern enterprises. By offering a unified security ecosystem, Fortinet aims to simplify the management of cybersecurity infrastructure while enhancing overall protection. This strategy has resonated strongly with businesses of all sizes, from small and medium enterprises to large corporations and government entities, contributing to Fortinet's robust growth and market position.

The ownership structure of FTNT stock is a mix of institutional, retail and individual investors. Approximately 41.76% of the company’s stock is owned by Institutional Investors, 16.22% is owned by Insiders and 42.02% is owned by Public Companies and Individual Investors. Ken Xie holds 8.35% of the company.

It's worth noting that CTO Michael Xie holds 7.44% of the company. So, together both brothers hold 15.79% of the company, which is a positive sign.

🏰 Economic Moat Overview

Fortinet possesses a wide economic moat, primarily derived from two key sources: high customer switching costs and a powerful network effect. The company's platform approach to cybersecurity, which integrates various aspects of an organization's security needs under a single umbrella, has been instrumental in creating and reinforcing these competitive advantages. As customers deeply integrate Fortinet's solutions into their IT infrastructure and business processes, the cost and complexity of switching to alternative providers become increasingly prohibitive. This entrenchment is further strengthened by the critical nature of cybersecurity in today's digital landscape, where the risks associated with changing security providers extend beyond mere financial considerations to include potential vulnerabilities during transition periods.

The network effect reinforcing Fortinet's moat stems from its ability to gather and analyze vast amounts of threat data across its extensive customer base. As more clients adopt Fortinet's platforms, the company's ability to detect and mitigate cyber threats improves, benefiting all users. This virtuous cycle enhances the value proposition of Fortinet's offerings, attracting more customers and further widening the moat. The company's FortiGuard Labs, which continuously analyzes threat intelligence from its global network of sensors, exemplifies this network effect in action, providing rapid threat detection and response capabilities that improve with scale.

Furthermore, Fortinet's economic moat is bolstered by its strong position in the convergence of networking and security. The company's expertise in areas such as software-defined wide-area networking (SD-WAN) and next-generation firewalls places it at the forefront of this trend, allowing it to offer integrated solutions that address both networking and security needs. This convergence not only increases the value proposition for customers but also raises barriers to entry for potential competitors who may lack expertise in one or both of these domains.

🚀 Business Strategy

Fortinet's business strategy revolves around providing a comprehensive, integrated cybersecurity platform that addresses the evolving needs of organizations in an increasingly complex digital landscape. The company's approach is multifaceted, focusing on several key areas to drive growth and maintain its competitive edge. At the core of this strategy is Fortinet's commitment to continuous innovation, with a significant portion of its resources dedicated to research and development. This focus on innovation enables Fortinet to stay ahead of emerging threats and adapt its offerings to meet changing customer requirements.

A key element of Fortinet's strategy is its emphasis on organic growth through the development of in-house technologies. Unlike some competitors who rely heavily on acquisitions to expand their capabilities, Fortinet has primarily focused on building its solutions internally. This approach, while potentially slower in some areas, has allowed the company to maintain a cohesive and well-integrated product portfolio. However, Fortinet has not completely eschewed acquisitions, remaining open to strategic purchases that can complement its existing offerings or provide entry into new market segments.

Fortinet's go-to-market strategy emphasizes a land-and-expand model, where the company initially engages customers with core offerings such as next-generation firewalls and then cross-sells additional security solutions. This approach has proven effective in increasing customer lifetime value and deepening Fortinet's entrenchment within client organizations. The company has also been successful in moving upmarket, targeting larger enterprise customers who tend to have more complex security needs and higher lifetime values. This is evidenced by the 48% year-over-year increase in the number of $1-million-plus deals.

Another crucial aspect of Fortinet's strategy is its focus on addressing key growth areas within the cybersecurity market. These include Secure Access Service Edge (SASE), cloud security, and security operations (SecOps). By investing in these high-growth segments, Fortinet aims to capture a larger share of the expanding cybersecurity market and position itself as a comprehensive security provider capable of meeting diverse customer needs.

💰 Profit Drivers

Fortinet's profit drivers are underpinned by several key factors that contribute to its robust financial performance and growth prospects. The company's revenue growth is projected to maintain a strong trajectory, with analysts forecasting a 14% compound annual growth rate over the next five years. This growth is expected to be driven by the continued expansion of Fortinet's customer base, increased penetration of existing accounts, and the introduction of new products and services aligned with emerging security trends.

A significant driver of Fortinet's profitability is its ability to leverage its existing customer relationships to drive additional sales. The company's platform approach facilitates upselling and cross-selling opportunities, allowing Fortinet to increase its wallet share within customer organizations. This strategy is particularly effective with larger enterprise clients, who often have diverse and complex security needs that can be addressed by multiple Fortinet solutions.

Fortinet's gross margins have historically been strong, hovering in the mid-70% range. However, as the company continues to grow and increase its focus on software-based solutions, there is potential for further margin expansion. Analysts project that GAAP gross margins could reach the low 80% range over the next decade, driven by the increasing proportion of high-margin software and subscription revenues in Fortinet's sales mix.

On the operational front, Fortinet has demonstrated a commitment to improving profitability while maintaining investments in growth initiatives. The company's adjusted operating margins have shown consistent improvement, reaching 32.5%, an expansion of 400 basis points year-over-year. Management has set an ambitious target of achieving non-GAAP operating margins in the mid-30s by fiscal 2028, indicating a continued focus on operational efficiency and scalability.

The growing importance of cybersecurity in the face of increasing digital threats also serves as a fundamental profit driver for Fortinet. As organizations prioritize their security spending, Fortinet's comprehensive suite of solutions positions the company to capture a significant share of this expanding market. Furthermore, the trend towards vendor consolidation in the cybersecurity space plays to Fortinet's strengths as a platform provider, potentially driving increased adoption of its integrated security fabric.

✅ Advantages

Fortinet possesses several key advantages that contribute to its strong market position and growth prospects. Foremost among these is the company's dominant position in the fragmented cybersecurity market. Despite being a market leader, Fortinet still has significant room for expansion, as the cybersecurity landscape remains highly diversified with numerous smaller players. This fragmentation presents Fortinet with ample opportunities to further consolidate its position and capture additional market share through both organic growth and strategic acquisitions.

Another significant advantage is Fortinet's ability to consistently add new growth drivers beyond its core offerings. The company has successfully expanded into adjacent markets such as cloud security, SASE, and SecOps, diversifying its revenue streams and reducing reliance on any single product line. This diversification not only opens up new avenues for growth but also enhances Fortinet's value proposition as a comprehensive security provider.

Fortinet's renewed focus on profitability is also a notable advantage. The company has demonstrated a commitment to improving operational efficiency and expanding margins without compromising its growth trajectory. This balanced approach to financial management positions Fortinet well to deliver sustainable long-term value to shareholders while maintaining the flexibility to invest in strategic initiatives.

The company's strong technology foundation and commitment to innovation serve as additional advantages. Fortinet's significant investment in research and development has enabled it to stay at the forefront of emerging security trends and continuously enhance its product offerings. This innovation-driven approach helps Fortinet maintain its competitive edge in a rapidly evolving technological landscape.

❌ Disadvantages

Despite its strong market position, Fortinet faces certain challenges and disadvantages that could impact its future performance. One of the primary challenges is the potential difficulty in sustaining high growth rates as the company's revenue base expands. The law of large numbers suggests that maintaining the same pace of growth becomes increasingly challenging as a company grows larger, and Fortinet may need to work harder to find new sources of growth to offset any potential slowdown in its core markets.

Another potential disadvantage lies in Fortinet's historically conservative approach to acquisitions. While the company has primarily focused on organic growth, some competitors have been more aggressive in acquiring new technologies and market share. This approach may have led to slower expansion in certain emerging areas of cybersecurity, potentially allowing competitors to gain footholds in these markets.

Fortinet's renewed emphasis on profitability, while generally positive, could potentially create tensions with growth objectives in the short term. Balancing the need for continued investments in innovation and market expansion with the desire for margin improvement will require careful management and may involve trade-offs that could impact the company's competitive position if not managed effectively.

The highly competitive nature of the cybersecurity market also presents ongoing challenges for Fortinet. The company faces competition from both established players and innovative startups across various segments of its business. Maintaining technological leadership and market share in this dynamic environment requires constant vigilance and investment.

🏛️ Capital Allocation

Fortinet's approach to capital allocation reflects a balanced strategy aimed at supporting growth, maintaining financial flexibility, and delivering value to shareholders. The company has historically prioritized internal investments, particularly in research and development, to drive organic growth and innovation. This focus on in-house development has been a cornerstone of Fortinet's strategy, enabling the company to build a cohesive and integrated product portfolio.

In recent years, Fortinet has demonstrated a more proactive approach to shareholder returns. In 2022, the company's board of directors authorized a substantial share repurchase program of up to $1 billion, signalling confidence in the company's financial position and commitment to returning capital to shareholders. This move represents a shift in Fortinet's capital allocation strategy, balancing growth investments with direct shareholder returns.

While Fortinet has been relatively conservative in its approach to acquisitions compared to some peers, the company remains open to strategic opportunities that can complement its existing offerings or provide entry into new market segments. Any future acquisitions are likely to be targeted and aligned with Fortinet's overall strategy of building a comprehensive security platform.

📰 To read: Fortinet to Acquire Lacework, Enhancing the Industry’s Most Comprehensive Cybersecurity Platform

The company maintains a strong balance sheet, with significant cash reserves and positive cash flow margins. This financial strength provides Fortinet with the flexibility to pursue growth opportunities, whether through internal investments or strategic acquisitions, while also maintaining a buffer against potential market downturns.

Fortinet does not currently pay a dividend, preferring to reinvest profits into the business to fuel growth and innovation. This approach aligns with the company's focus on capturing opportunities in the expanding cybersecurity market and is appropriate given the industry's rapid pace of technological change and the ongoing need for investment in new solutions.

🚩 Risks and Uncertainty

Fortinet, like any company in the dynamic cybersecurity sector, faces several risks and uncertainties that could impact its future performance. One of the primary risks is the potential for rapid technological change or disruptive innovations that could challenge Fortinet's market position. The cybersecurity landscape is characterized by constant evolution, with new threats and attack vectors emerging regularly. Fortinet must continually innovate and adapt its solutions to stay ahead of these changes, and any failure to do so could result in a loss of market share to more agile competitors or new entrants.

Another significant risk factor is the intense competition within the cybersecurity market. Fortinet faces competition from both established players and innovative startups across various segments of its business. This competitive pressure could lead to pricing pressures, increased marketing costs, or the need for higher R&D investments, potentially impacting profitability.

The company's growth strategy, which includes expanding into new market segments and moving upmarket to target larger enterprise customers, also carries inherent risks. These new markets may have different competitive dynamics or require different go-to-market strategies, and success is not guaranteed. Additionally, as Fortinet grows larger, maintaining high growth rates becomes increasingly challenging, potentially disappointing investors accustomed to rapid expansion.

Fortinet's reliance on hardware sales, particularly its next-generation firewalls, exposes the company to potential shifts in customer preferences towards cloud-based or software-defined security solutions. While Fortinet has been investing in these areas, a rapid shift could negatively impact the company's revenue and margins in the short term.

Cybersecurity companies like Fortinet also face reputational risks associated with high-profile security breaches or vulnerabilities in their products. Any significant security failure could damage customer trust and lead to both reputational and financial consequences.

Geopolitical factors and changes in global trade policies could also impact Fortinet's business, particularly given its international operations and global supply chain. Trade restrictions, tariffs, or other regulatory changes could affect the company's ability to sell its products in certain markets or source components for its hardware products.

Lastly, as a technology company, Fortinet faces risks related to intellectual property disputes and potential patent litigation. The company must navigate a complex landscape of technology patents and defend its innovations while avoiding infringement on others' intellectual property.

💲Current Valuation

Fortinet is currently trading at a Price/Earnings (P/E) ratio of 39.44, which is lower than its 5-year average of 55.96. This suggests the stock may be relatively undervalued compared to its recent historical valuation. The Price/Sales ratio of 8.81 and Price/Cash Flow ratio of 25.69 are also below their 5-year averages. However, these multiples are still relatively high compared to the broader market, indicating investors are pricing in strong future growth expectations.

The company's PEG ratio (Price/Earnings to Growth) is currently 1.28, which is higher than in recent years but still below the 5-year average of 2.49. Suggesting Fortinet's current price is reasonably aligned with its expected growth rate. The Enterprise Value/EBITDA ratio of 31.86 is lower than the 5-year average of 44.14, potentially indicating an attractive valuation from an acquisition standpoint. However, it's worth noting that the Price/Book ratio has increased significantly in recent years.

📈 Past and Future

FTNT shows strong long-term performance, outpacing both its industry and the broader market index over 5-year and 10-year periods. The 5-year return of 31.43% and a 10-year return of 28.20% significantly exceed industry and index returns.

However, recent performance has lagged. FTNT posted a negative 1-year return of -20.27%, contrasting sharply with positive industry and index returns. Year-to-date and 6-month returns, while positive, trail behind peers. This suggests Fortinet is facing near-term challenges despite its history of long-term outperformance. Investors should consider this mixed performance profile, weighing recent struggles against the company's strong long-term track record.

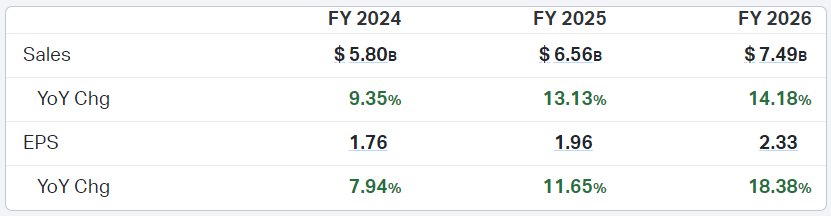

Analyst estimates for Fortinet project strong growth over the next three fiscal years. Sales are expected to increase from $5.80 billion in FY 2024 to $7.49 billion in FY 2026, with the year-over-year growth rate accelerating from 9.35% to 14.18%. This represents a compound annual growth rate of about 13.7%.

Earnings per share (EPS) growth is forecast to outpace revenue growth, rising from $1.76 in FY 2024 to $2.33 in FY 2026. The EPS growth rate is projected to reach 18.38% year-over-year in FY 2026, suggesting improving profitability.

🥇 Competitors

Fortinet operates in a highly competitive cybersecurity market, facing competition from a range of players across various segments of its business. Key competitors include:

👉 Palo Alto Networks: A major player in the network security space, Palo Alto Networks competes directly with Fortinet in areas such as next-generation firewalls and cloud security. The company has been aggressive in its acquisition strategy to expand its product portfolio.

👉 Cisco Systems: As a networking giant, Cisco offers a broad range of security solutions that compete with Fortinet's offerings. Cisco's integrated approach to networking and security presents a significant competitive challenge.

👉 Check Point Software Technologies: Another well-established player in the network security market, Check Point competes with Fortinet in firewall and other security appliance categories.

👉 Zscaler: A cloud-native security company that competes with Fortinet in the growing Secure Access Service Edge (SASE) market. Zscaler's cloud-first approach contrasts with Fortinet's hybrid offerings.

👉 CrowdStrike: While primarily focused on endpoint security, CrowdStrike's expansion into other security areas brings it into increasing competition with Fortinet, particularly in the security operations space.

👉 SonicWall: A competitor in the small and medium-sized business (SMB) market, SonicWall offers network security solutions that compete with Fortinet's offerings for smaller organizations.

These competitors, along with numerous other players in the cybersecurity space, contribute to a highly dynamic and competitive market environment. Fortinet's ability to differentiate its offerings, innovate rapidly, and provide integrated solutions across multiple security domains will be crucial in maintaining and expanding its market position against these strong competitors.

🤔 Market Trends and Final Thoughts

The cybersecurity market continues to evolve rapidly, driven by the increasing sophistication of cyber threats, the ongoing digital transformation of businesses, and the shift towards cloud and hybrid IT environments. Several key trends are shaping the landscape in which Fortinet operates:

👉 Consolidation of security vendors: Organizations are increasingly looking to reduce the complexity of their security infrastructure by consolidating their vendor relationships. This trend plays to Fortinet's strengths as a platform provider offering a broad range of integrated security solutions.

👉 Rise of cloud-native and hybrid security solutions: As businesses continue to migrate to the cloud, there's a growing demand for security solutions that can protect both on-premises and cloud-based assets seamlessly. Fortinet's investments in cloud security and SASE position it well to capitalize on this trend.

👉 Increasing importance of AI and machine learning in cybersecurity: Advanced analytics and automated threat detection and response capabilities are becoming crucial in dealing with the volume and sophistication of modern cyber threats. Fortinet's FortiGuard Labs and its AI-driven security fabric align well with this trend.

👉 Growing focus on zero-trust security models: The shift towards distributed workforces and cloud-based applications is driving the adoption of zero-trust security approaches. Fortinet's zero-trust access solutions address this growing market need.

👉 Expansion of IoT and edge computing: The proliferation of Internet of Things (IoT) devices and edge computing is creating new security challenges that require specialized solutions. Fortinet's broad portfolio positions it to address these emerging security needs.

In conclusion, Fortinet stands as a strong player in the cybersecurity market, with a comprehensive product portfolio, solid financial performance, and a clear strategy for future growth. The company's wide economic moat, built on high switching costs and network effects, provides a sturdy foundation for long-term success. Fortinet's focus on innovation, coupled with its platform approach to security, aligns well with key market trends and customer needs.

However, the company also faces significant challenges, including intense competition, the need to continuously innovate in a rapidly evolving threat landscape, and the potential for slowing growth as it increases in size. Fortinet's ability to navigate these challenges while capitalizing on its strengths will be crucial in determining its future success.

For investors, Fortinet represents a compelling opportunity in the high-growth cybersecurity sector. Given the dynamic nature of the industry and the uncertainties inherent in technology investments, potential investors should carefully consider their risk tolerance and investment horizon when evaluating Fortinet as a potential addition to their portfolios.

This is not a financial or investing recommendation. It is solely for educational purposes.