Updated Valuations: PINS, SQ, IDXX, MKTX, FTNT, and SBUX

Updated valuations of companies covered by Long-Term Pick after the latest quarter earnings reports.

In November, some companies covered by Long-Term Pick (updated page) released their quarterly earnings reports. It's time to update their valuations and review the latest reports. Some explanations regarding screenshots with fair price estimates:

I marked cells that I updated as grey (after the latest earning reports)

Fair-to-Current Price and Current Price/Fair Price: green - undervalued, blue - fairly valued, yellow - overvalued

Some Future EPS Growth marked as green means that the projected earnings growth is even higher; 20% is my maximum

Additionally, I included updated current valuations alongside their 5-year averages for easy comparison. I also added average future price estimates from other analysts to compare with my Base Fair Price Estimates.

Related publication:

Pinterest (PINS): Undervalued 🟢

🏷️ Updated Valuation

Latest earnings report (November 07, 2024):

✍️ Summary

Revenue: $898 million, up 18% year-over-year.

Adjusted EBITDA: $242 million with a margin of 27%, up approximately 280 basis points year-over-year.

Monthly Active Users (MAUs): 537 million, growing 11% year-over-year.

US and Canada Revenue: $719 million, growing 16% year-over-year.

Europe Revenue: $137 million, growing 20% year-over-year.

Rest of World Revenue: $42 million, growing 38% on a reported basis or 45% on a constant currency basis.

Ad Impressions Growth: 41% year-over-year.

Ad Pricing Decline: 17% year-over-year.

Cash, Cash Equivalents, and Marketable Securities: $2.4 billion.

Share Repurchases: $466 million in Q3, $500 million year-to-date.

Q4 2024 Revenue Guidance: $1.125 billion to $1.145 billion, representing 15% to 17% growth year-over-year.

Q4 Non-GAAP Operating Expenses Guidance: $495 million to $510 million, growing 11% to 14% year-over-year.

👍 Positive Points

Reported a record high of 537 million monthly active users in Q3 2024, reflecting an 11% year-over-year growth.

Achieved an 18% year-over-year revenue growth in Q3 2024, driven by strong performance in lower funnel revenue.

Has successfully integrated AI into its platform, enhancing user engagement and ad relevance, leading to a 300 basis point improvement in actionable engagement.

Has expanded its third-party demand partnerships, including an extension of its relationship with Amazon Ads in Canada and Mexico.

Launched Performance+, an AI-driven advertising tool that simplifies campaign creation and improves cost per action by 10% on average.

👎 Negative Points

The food and beverage subsector of CPG continues to experience softness, impacting overall growth.

Despite strong revenue growth, ad pricing declined by 17% year-over-year due to a mix shift from international markets.

The adoption of new features like Performance+ is still in the early stages, with advertisers limiting budget shifts during the holiday peak period.

Faces macroeconomic headwinds, particularly in the food and beverage category, which affects revenue growth.

Still in the early days of its international expansion efforts, which may take time to significantly impact revenue.

💲Current Valuation

📈 Price Forecast

Block (SQ): Undervalued 🟢

🏷️ Updated Valuation

Latest earnings report (November 07, 2024):

👍 Positive Points

Reported a 19% year-over-year increase in gross profit, reaching $2.25 billion, with significant growth in both the Square and Cash App segments.

Achieved its highest quarterly profitability ever, with improvements in adjusted operating income and adjusted EBITDA.

Raised its full-year 2024 guidance for adjusted operating income and adjusted EBITDA, indicating strong financial performance.

Seeing strong momentum in Cash App, with improved attach rates on paycheck deposits and other financial products.

Investing in growth opportunities, particularly in go-to-market strategies, to drive further expansion in 2025.

👎 Negative Points

There are discrete items impacting gross profit growth, such as delays in transaction cost benefits and expansion of Cash App Borrow, which are now expected to materialize in 2025.

Faces regulatory uncertainties in the fintech and banking sectors, which could impact its operations and growth strategies.

Experiencing moderated growth in monthly active users for Cash App, with expectations to end the year at around 57 million, indicating challenges in user acquisition.

Making deliberate trade-offs in new active growth to focus on engagement and platform health, which may impact short-term user growth metrics.

Still in the early stages of rolling out new products like Afterpay on Cash App Card, indicating potential delays in realizing full benefits from these initiatives.

💲Current Valuation

📈 Price Forecast

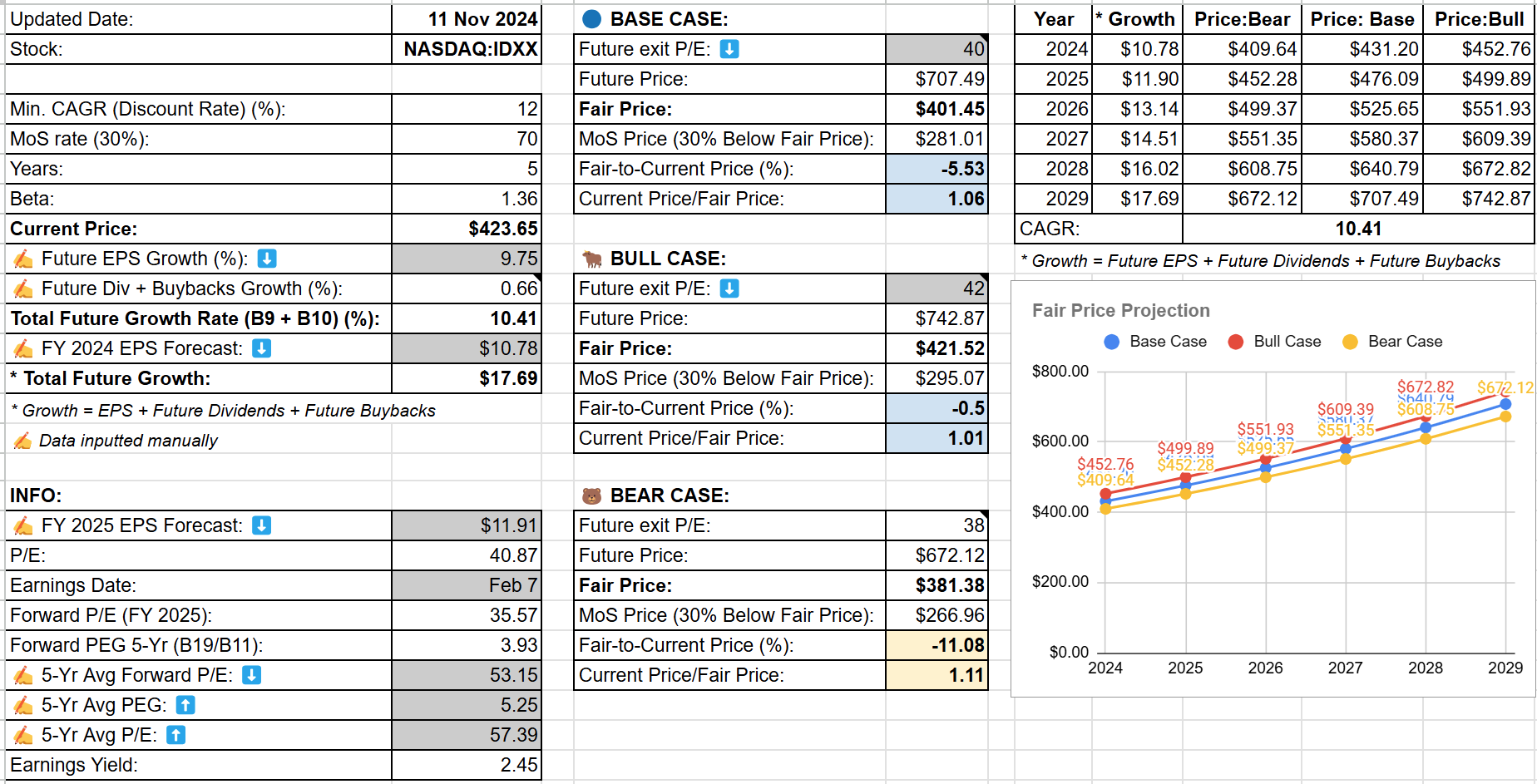

IDEXX (IDXX): Fairly Valued 🔵

🏷️ Updated Valuation

Latest earnings report (October 31, 2024):

✍️ Summary

Organic Revenue Growth: 6% overall, with 7% in CAG Diagnostic recurring revenues and 13% in the water business.

EPS: $2.80 per share, up 11% as reported and 12% on a comparable basis.

Gross Margin: 61.1%, an increase of 140 basis points on a comparable basis.

Operating Margin: 31.2%, up 110 basis points year on year as reported.

Free Cash Flow: $192 million in Q3.

Net Income to Free Cash Flow Conversion Ratio: 91% on a trailing 12-month basis.

Capital Allocation: $225 million in share repurchases, supporting a 1.1% reduction in diluted shares outstanding.

Updated Full-Year Organic Revenue Growth Outlook: 5.3% to 6%.

Updated Full-Year EPS Outlook: $10.37 to $10.53 per share.

Global Premium Instrument Placements: 4,128 units in Q3, a decrease of approximately 10% compared to prior levels.

Orders for New IDEXX inVue Analyzer: 691 orders secured in North America.

👍 Positive Points

Reported a solid 6% organic revenue growth in Q3 2024, driven by 7% growth in CAG Diagnostic recurring revenues and 13% growth in the water business.

Achieved strong profit performance with an EPS of $2.80 per share, up 11% as reported and 12% on a comparable basis.

Secured nearly 700 orders for its new inVue analyzer, indicating strong market interest and potential future revenue growth.

Maintained high customer retention rates of over 97% and achieved double-digit growth in its premium instrument install base.

International CAG Diagnostic recurring revenue grew by 10% organically, supported by strong new business gains and high premium instrument placements.

👎 Negative Points

CAG Diagnostic recurring revenue growth in the US was constrained by near-term macroeconomic pressures and sector headwinds, leading to a reduction in full-year organic revenue growth guidance.

Experienced a 2% organic decline in Livestock, Poultry, and Dairy (LPD) revenues, impacted by lower Asia swine testing and herd health screening revenues.

Reference lab revenue growth was modest, affected by price realization impacts from major new customer agreements.

US clinical visit growth declined by 2.1%, with a higher 3.4% decline in discretionary wellness visits, impacting diagnostic revenue growth.

Faced challenges from severe weather events, which negatively impacted Q4 revenue growth expectations.

💲Current Valuation

📈 Price Forecast

MarketAxess (MKTX): Overvalued 🟡

🏷️ Updated Valuation

Latest earnings report (November 06, 2024):

✍️ Summary

Revenue: $270 million, up 20% from the prior year.

Diluted Earnings Per Share: $1.19, representing an increase of 30%.

Commission Revenue: $180 million, up 20% for the quarter.

Information Services Revenue: $13 million, up 10%.

Post-Trade Services Revenue: $10 million, up 6%.

Trading Volume: 254 billion, up 41% from key client segments.

Operating Expenses: $120 million, increased 14% compared to the prior year.

Cash and Investments: $610 million as of September 30th.

Free Cash Flow: $310 million, an increase of 4% over last quarter.

Share Repurchase: 66,000 shares were repurchased during the third quarter at a cost of $15 million.

👍 Positive Points

Reported a 20% growth in revenue, driven by strong growth in market volumes.

Achieved a 30% increase in diluted earnings per share due to disciplined expense management.

Emerging markets trading volume saw significant growth, with a 51% increase in Latin America and 30% in Asia-Pacific.

Launched a strategic fixed-income data partnership with S&P Global, enhancing their data offerings.

Open Trading, MarketAxess's all-to-all liquidity pool, generated a record trade count, up 27% from the prior year.

👎 Negative Points

Experienced a decline in U.S. high-grade market share, attributed to lower portfolio trading and a shift to large block trading.

Still working to catch up with competitors in portfolio trading, particularly in Europe and emerging markets.

Fee capture was impacted by a decrease in U.S. high-yield activity and increased portfolio trading.

Variable costs increased due to higher trading activity, impacting overall expense management.

Faces challenges in increasing electronification in the high-touch block trading market.

💲Current Valuation

📈 Price Forecast

Fortinet (FTNT): Fairly Valued 🔵

🏷️ Updated Valuation

Latest earnings report (November 07, 2024):

👍 Positive Points

Reported a record gross margin of 83.2% and an operating margin of 36.1%, indicating strong financial performance.

Total revenue grew by 13%, driven by a 19% increase in service revenue and a return to growth in product revenues.

Added over 6,000 new logos, showcasing the resilience of small enterprise customers and the strength of its channel partner ecosystem.

Continues to lead in the Gartner Magic Quadrant for SD-WAN for the fifth consecutive year, highlighting its strong market position.

Investing in its global infrastructure, including over 3 million square feet of Class A office space, which provides a long-term cost advantage.

👎 Negative Points

The billings guidance for the next quarter came in below Street expectations, indicating potential challenges in meeting market forecasts.

There is a cautious outlook on large deals maturing in the final month of the quarter, which could impact financial performance.

The competitive landscape is seeing increased discounting and bundling from larger vendors, which could pressure Fortinet's pricing strategies.

Facing challenges in the European market, with no expectation of outsized performance from the region.

There is a risk associated with the timing and magnitude of the expected firewall refresh cycle in 2025, which could affect future growth.

💲Current Valuation

📈 Price Forecast

Starbucks (SBUX)

🏷️ Updated Valuation

I have not estimated SBUX Fair Price yet but going to do this in the near future.

Latest earnings report (October 30, 2024):

✍️ Summary

Q4 Revenue: $9.1 billion, down 3% from the prior year.

Q4 Comparable Store Sales: Declined 7%, with an 8% decrease in transactions and a 2% increase in average ticket.

US Comparable Store Sales: Declined 6%, with a 10% decrease in transactions and a 4% increase in average ticket.

China Comparable Store Sales: Declined 14%, with an 8% decrease in average ticket and a 6% decrease in transactions.

Q4 Operating Margin: 14.4%, contracting 370 basis points from the prior year.

Q4 EPS: $0.80, down 24% from the prior year.

Full Year Revenue: $36.2 billion, up 1% from the prior year.

Full Year Operating Margin: 15%, contracting 110 basis points from the prior year.

Full Year EPS: $3.31, declining 6% from the prior year.

Active Starbucks Rewards Membership: Grew 4% year-over-year to 33.8 million.

Dividend Increase: Quarterly cash dividend increased from $0.57 to $0.61 per share.

👍 Positive Points

Reported a 7% net new company-operated store growth, indicating expansion efforts.

Active Starbucks Rewards membership grew 4% year-over-year to 33.8 million, showing customer engagement.

Announced an annual increase in the quarterly cash dividend from $0.57 to $0.61 per share, marking the 14th consecutive year of increases.

Focusing on improving in-store operational efficiencies, which yielded savings of approximately 150 basis points in the quarter.

Plans to eliminate the upcharge for non-dairy milks, potentially enhancing customer satisfaction and loyalty.

👎 Negative Points

Q4 consolidated revenue was $9.1 billion, down 3% from the prior year, driven by a 7% decline in comparable store sales.

Traffic declined across all channels and day parts, with the most pronounced decline in the afternoon day part.

China comparable store sales declined 14%, impacted by intensified competition and a soft macro environment.

Q4 consolidated operating margin contracted 370 basis points from the prior year, primarily due to deleverage and increased promotional activities.

Suspended its guidance for full fiscal year 2025 due to the CEO transition and current business challenges.

💲Current Valuation

📈 Price Forecast

This is not a financial or investing recommendation. It is solely for educational purposes.

Thank you for being a reader of Long-Term Pick! Your valuable feedback is welcome, so feel free to share your thoughts.

Thank you for these detailed, realistic analyses, clearly written and charted. You are one of the best!

Thank you.