IDEXX: Great Business But a Bit Overpriced

IDEXX Laboratories (IDXX) is a global leader in veterinary diagnostics. Has grown steadily over the years, benefiting from the rising trend of pet ownership.

Changelog:

Feb 8, 2025: Updated fair price valuation: $487.

Jan 24, 2024: Overview: Share Repurchase Program Expansion, CFO Transition, Expansion of Diagnostic Test Menu, Launch of Innovative Software Solution, Expansion of Fecal Dx Testing Platform, and New Slide-Free Cellular Analyzer Launch.

Nov 19, 2024: Updated fair price valuation: $401.45.

IDEXX Laboratories is an American company that plays a key role in the global veterinary industry. Specializing in diagnostic tools and software, IDEXX provides essential products for animal healthcare, including tests for pets, livestock, and water safety. The company's innovative solutions help veterinarians quickly diagnose and treat animals, making IDEXX a leader in its field. With a strong focus on technology, IDEXX has built a unique position in the market, serving thousands of animal hospitals and clinics around the world. Its products are trusted to improve pet care and public health globally.

Previous publication:

Content:

💡 Investment Thesis

🧐 Company Overview

🏰 Economic Moat

🚀 Business Strategy

✅ Advantages

❌ Disadvantages

🏛️ Capital Allocation

🥇 Competitors

⏮️ Past

📶 Future

💲Current Valuation

🏷️ Fair Price

☑️ Checklist

✍️ Due Diligence

💡 Investment Thesis

IDEXX Laboratories is a leader in veterinary diagnostics, with a strong economic moat. The company’s focus on recurring revenue streams, including consumables and software solutions, provides stable, long-term income. IDEXX continues to benefit from the growing demand for advanced animal healthcare, particularly through its Companion Animal Group (CAG), which has shown steady revenue growth.

While U.S. veterinary visits have slightly declined, IDEXX's global expansion, particularly in Europe and Asia, supports its growth strategy. The company’s recent product innovations, like the Invue Dx analyzer, strengthen its position as a market leader, ensuring that it remains essential to veterinary practices worldwide. Solid financial health and strong capital allocation, strategic acquisitions and continued R&D investments.

Currently, the stock is trading below its 5-year averages but, based on my Fair Price Estimate, is overvalued by 9%. At least, might be a great choice for your Watch List.

⬇️ Download Quick Analysis in PDF/PNG + Market Trends (Recommended)

🧐 Company Overview

Incorporated: 1983

Sector: Healthcare

Industry: Diagnostics & Research

Stock Style: Mid Growth

Market Cap: $37.69 Bil

Total Number of Employees: 11,000

Website: https://www.idexx.com/en/

Earnings Date: Oct 31, 2024IDEXX Laboratories (IDXX) is a global leader in veterinary diagnostics, serving companion animals, livestock, poultry, and water quality testing markets. The company primarily focuses on providing diagnostic products and services for veterinarians through its Companion Animal Group (CAG). This segment accounts for over 90% of the company's revenue, showcasing its dominance in the pet healthcare industry.

To Read: About Idexx

IDEXX has grown steadily over the years, benefiting from the rising trend of pet ownership and the increased willingness of pet owners to invest in diagnostics and preventive care. The company’s innovations in diagnostic tools, in-house analyzers, and management software have strengthened its leadership position in the global veterinary market.

Jonathan J. Mazelsky is the President and CEO of the company, having been appointed to this role on October 23, 2019. He initially served as the Interim CEO starting June 28, 2019, following the medical leave of former CEO Jonathan Ayers due to an accident. Mazelsky joined IDEXX in August 2012 as Executive Vice President. Before joining IDEXX, he held senior positions at Philips Healthcare, managing various segments related to medical imaging and radiation therapy from 2001 to 2012.

🏰 Economic Moat

IDEXX has a wide economic moat, which is largely supported by its strong intangible assets and significant switching costs for customers. Veterinary practices that adopt IDEXX's diagnostic equipment and management software tend to remain loyal, as switching to a competitor would require significant investment in training and system integration. This loyalty is strengthened by the integrated nature of IDEXX’s solutions, where diagnostic test data and management software work together seamlessly to improve workflow efficiency in animal hospitals.

It’s worth noting that the company continuously innovate and offers a wide range of diagnostic tools. This further enhances its moat, making it difficult for competitors to penetrate its market share.

Key Components:

Intangible Assets: Valuable brands, patents, and regulatory approvals.

Switching Costs: The integration of their systems into veterinary practices creates significant switching costs for customers. Once a practice adopts IDEXX's diagnostic tools and software, changing to a competitor would involve considerable expense.

Network Effects: As more veterinary practices adopt their products, the value of these products increases, creating a self-reinforcing cycle of growth and customer retention.

Cost Advantages: Great operational efficiencies and economies of scale — higher margins compared to competitors. Its five-year average operating margin is around 22.3%, indicating strong pricing power and operational efficiency.

Recurring Revenue Model: A significant portion of their revenue comes from recurring sources, such as consumables and software subscriptions. This model provides stability and predictability in cash flows, further.

🚀 Business Strategy

IDEXX’s business strategy is based on expanding its product offerings and geographical expansion. The company is a leader in the veterinary diagnostics space, offering a wide variety of tests, including in-house analyzers, rapid assays, and reference lab services. Its ability to cross-sell diagnostic tools and services, combined with a strong sales network, has helped it capture a large share of the global market. The company continues to focus on international expansion, with over 35% of its revenue generated from markets outside the United States.

In addition to its strong presence in the animal sector, IDEXX has also established a significant role in water quality testing and livestock diagnostics. These segments, while smaller, provide the company with diversified revenue streams. Their water testing solutions, for example, are used globally to detect microbial contaminants, contributing to public health and safety.

Core business segments:

Animal Health:

Diagnostic Products and Services: This segment is the largest, providing a range of veterinary diagnostic test kits, laboratory services, and software solutions. Products include in-clinic diagnostic tests and point-of-care instruments (such as the IDEXX Catalyst and Snap tests) that help veterinarians diagnose and monitor animal health.

Veterinary Software and Services: Practice management software solutions, including IDEXX Neo, which helps veterinary practices manage their operations more efficiently.

Water Quality Testing:

Testing products and services for water quality, focusing on ensuring the safety of drinking water and recreational waters. This includes kits and assays that test for contaminants like E. coli and other pathogens.

Dairy and Milk Quality:

Testing solutions for dairy farms, including milk quality tests and services that help ensure dairy products meet health and safety standards. IDEXX’s products support dairy producers in managing herd health and optimizing milk production.

Livestock and Poultry:

Diagnostics and health monitoring solutions for livestock and poultry, help farmers and producers to monitor animal health, reduce disease outbreaks, and enhance food safety.

✅ Advantages

A comprehensive suite of diagnostic solutions. The company’s products integrate diagnostic equipment, software, and services. This high level of integration strengthens IDEXX’s position as a one-stop solution provider, advancing long-term relationships with clinics and ensuring recurring revenue from sales.

Constant focus on innovation. By regularly launching new products and improving existing ones, the company stays ahead of competitors in the diagnostic space. For example, its cloud-based software solutions like IDEXX Neo and Cornerstone help veterinary clinics improve workflow efficiency, allowing for faster and more accurate diagnosis.

International expansion. By strengthening its presence in markets like Europe and Asia, IDEXX has managed to grow its customer base while benefiting from the rising global demand for advanced veterinary care. This global global presence leads to a diversified revenue base, reducing its reliance on any single market.

❌ Disadvantages

Heavy reliance on the U.S. market. While the company has expanded internationally, the U.S. remains its largest source of revenue, and any slowdown in veterinary visits or spending could significantly impact its financial performance. In recent quarters, veterinary visits in the U.S. have seen a decline, partly due to macroeconomic factors.

Foreign exchange rates. With a substantial portion of its revenue coming from international markets, IDEXX is vulnerable to currency fluctuations, which can negatively affect its top-line growth. In 2024, the strengthening U.S. dollar reduced the company’s revenues and operating profits from its international operations.

Debt levels have risen. While the company has maintained a strong balance sheet in the past, recent increases in debt have led to a lower current ratio, raising questions about its ability to cover short-term liabilities. Additionally, its reliance on share buybacks, particularly when the stock is overvalued, has been viewed by some investors as a less effective form of capital allocation.

🏛️ Capital Allocation

The company has historically maintained a conservative debt level, with a net debt-to-EBITDA ratio that typically hovers around 1x. Despite recent increases in debt, IDEXX has shown a commitment to reducing its debt over time, ensuring financial stability while continuing to pursue growth opportunities. The company does not pay dividends.

In terms of acquisitions, IDEXX has made several strategic moves, such as acquiring Bommeli Diagnostics to expand its presence in Europe and DVMinsight to strengthen its telemedicine capabilities. These acquisitions have been executed at reasonable prices and have helped the company enhance its product offerings and expand its market reach. Additionally, the company invests heavily in research and development, which allows it to consistently innovate and maintain its competitive edge in the diagnostic space.

One area where IDEXX’s capital allocation has faced criticism is its reliance on share buybacks. The company has opted to repurchase shares rather than issue dividends, which some investors see as a missed opportunity to return capital to shareholders. Given that IDEXX’s shares are often overvalued, these buybacks have been seen as potentially dilutive to long-term shareholder value.

🥇 Competitors

IDEXX’s primary competitors include Zoetis, Merck, and Elanco. Zoetis, in particular, presents strong competition, especially after acquiring Abaxis, which expanded its presence in the veterinary diagnostics market. Zoetis’ product offerings overlap with IDEXX’s, especially in diagnostic equipment and consumables, making it a direct rival. While Merck and Elanco also compete in the animal health space, their primary focus remains on pharmaceuticals, giving IDEXX a unique advantage in the diagnostic niche.

Let’s compare the current valuation with ZTS:

As we can see, IDXX is trading higher than ZTS. But IDXX has higher equity returns:

IDEXX maintains a strong market position due to its innovative products, integrated solutions, and strong relationships with veterinary clinics. It might be the reason why the market asses IDXX higher than ZTS.

⏮️ Past

In Q2 2024, IDEXX saw a 7% organic revenue growth, led by a 7% rise in CAG Diagnostic recurring revenues and a 10% increase in the Water business. Despite the overall growth, macroeconomic headwinds led to a 2% decline in clinical visit growth. EPS fell by 9% to $2.44, impacted by a $62 million litigation expense, though comparable EPS grew by 15%. For 2024, IDEXX revised its revenue guidance to $3.885-$3.945 billion, with an expected organic growth of 6.2%-7.8%. Despite challenges, IDEXX maintains strong operating margins and continues investing in innovation.

In the long run (5, 10, 15 years), IDEXX has outperformed both the industry and the S&P 500 (CAGR).

📶 Future

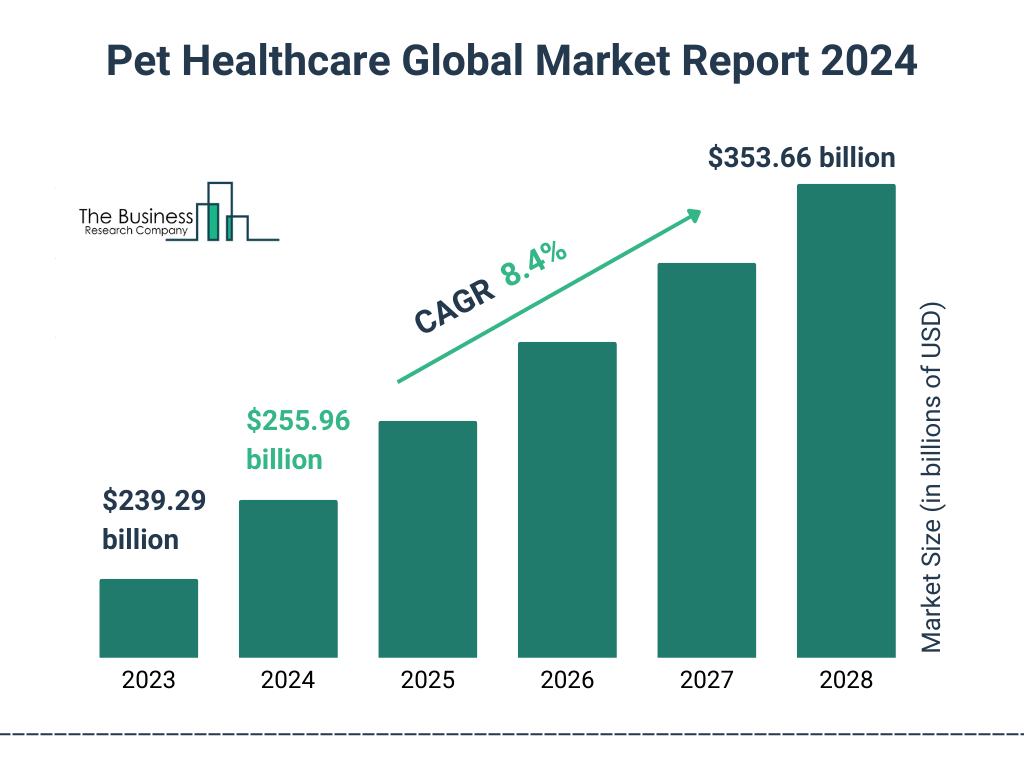

Based on The Business report, the pet healthcare global market size is expected to see strong growth in the next few years. It will grow to $353.66 billion in 2028 at a compound annual growth rate (CAGR) of 8.4%. The growth in the forecast period can be attributed to the growing ageing pet population, rise in pet adoption, focus on preventive care, economic trends, and advancements in veterinary science. Major trends in the forecast period include pharmaceutical innovations for pet health, personalized pet healthcare plans, e-commerce growth in pet medications, increased focus on mental health, and preventive dental care for pets.

Based on analyst forecasts, IDEXX Laboratories shows consistently improving growth momentum, with both sales and earnings expected to accelerate each year through FY2026.

Based on short-term price targets offered by nine TOP analysts, the average price target for the company comes to $554.56. The forecasts range from a low of $500.00 to a high of $607.00. The average price target represents an increase of 20.17% from the last closing price of $461.49.

The company currently has an average brokerage recommendation (ABR) of 1.85 on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell etc.) made by 10 brokerage firms. The current ABR compares to an ABR of 1.77 a month ago based on 11 recommendations.

💲Current Valuation

The current valuation shows that the stock is trading at a lower premium compared to its 5-year average. Key metrics like Price/Sales and Price/Earnings ratios have declined.

🏷️ Fair Price

➡️ Updated fair price valuation: https://longtermpick.com/p/updated-valuations-nov-24-2

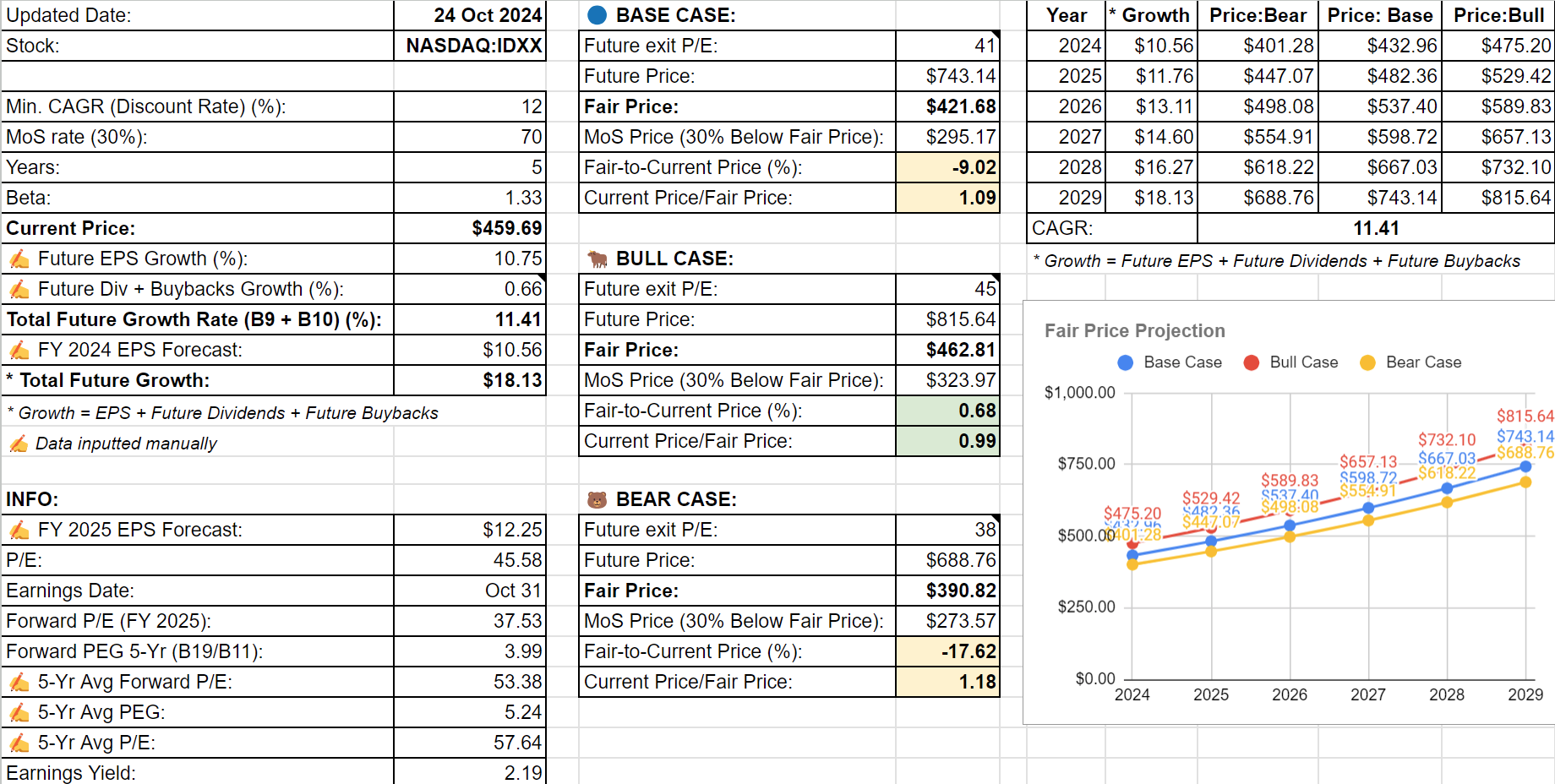

The Long-Term Pick's Fair Price (Base Case) for IDXX is $421.68. The current price of $460 is higher by 9%.

Fair-to-Current Price (%): 9%

Current Price/Fair Price: 1.09

I used:

Discount Rate: 12% (S&P 500 Next 5-Yr Growth Estimates is 11.80%)

Margin of Safety: 30%

Years: 5

Future EPS Growth Rate: 10.75% (Based on Yahoo Finance, Koyfin and Seeking Alpha)

Future Dividend and Buyback Yield: 0.66% (5-year average value is 0.66; only buybacks)

Total Future Annual Growth Rate: 10.75 + 0.66 = 11.41%

It is worth noting that a future CAGR of 11.41% is pretty real since the company has an even higher CAGR for 5, 10, and 15-year periods — see the “Past” section above.

To be honest, it was hard to determine Future Exit P/E for all cases (Base, Bear, and Bull) since the market has been estimating the company very high in the past. Just look at this:

So, what I did. For the Bull Case, I took the current P/E ratio (45). For the Bear Case, I took the lowest PE for the last 10 years - it was 38.51 in 2014. And for the Base Case, I took the value between them (41).

It's fairly priced only for the Bull Case.

☑️ Checklist

Profitability:

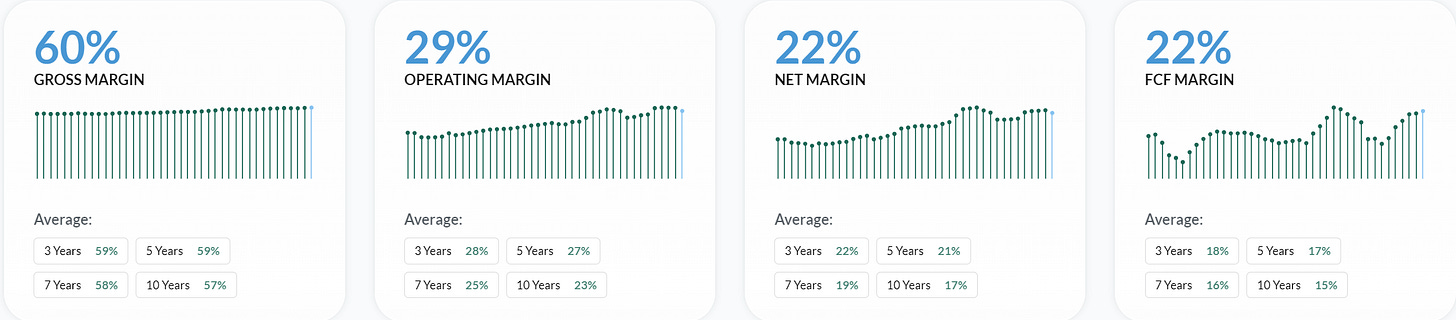

✅ Gross margin at least 40%: 60%

✅ Net margin at least 10%: 22%

✅ Management (ROIC, ROCE, ROE, ROA): Yes (All above 10%)

✅ Piotroski F-Score: 7 of 9 (Not passed: Higher ROA yoy, Higher Asset Turnover yoy)

✅ Revenue surprises in last 7 years: Yes (Based on TradingView's data)

✅ EPS surprises in last 7 years: Yes (Based on TradingView's data)

❌ EPS growth YoY 7 years in a row: No (2022)

Valuation and Advantage:

✅ Valuation below its 5-yr average: Yes

✅ Does it have a moat: Yes (wide)

Shares:

❌ Insider ownership at least 5%: No (0.94%)

✅ Less shares outstanding YoY: Yes

❌ Insider buys last six months: No

Price:

✅ 1-year stock price forecast is above 10%: +20%

❌ Next 5-Yr Growth Estimates (CAGR) is above S&P 500: No (10.75% vs 11.80%; Based on Yahoo Finance)

❌ DCF Value: $281 (Overvalued by 39%; 10 years, discount rate: 10%, terminal growth: 3%, equity model: FCFE)

✅ Short Interest below 5%: Yes (2.86%)

✍️ Due Diligence

Profitability (7.5 of 10):

✅ Positive Gross Profit: 2.3B USD

✅ Positive Operating Income: 1.1B USD

✅ Positive Net Income: 845.6m USD

✅ Positive Free Cash Flow: 839m USD

⚠️ Positive 1-Year Revenue Growth: 8%

⚠️ Positive 3-Year Revenue Growth: 8%

⚠️ Positive Revenue Growth Forecast: 9%

✅ Exceptional ROE: 63%

✅ Exceptional 3-Year Average ROE: 102%

❌ Declining ROE: 127% > 63%

✅ Exceptional ROIC: 31%

✅ Exceptional 3-Year Average ROIC: 34%

❌ Declining ROIC: 40% > 31%

Solvency (6.5 of 10):

✅ Short-Term Solvency

✅ Long-Term Solvency

❌ Positive Net Debt: 373.2m USD

✅ Low D/E: 0.49

✅ High Altman Z-Score: 17.39

This is not a financial or investing recommendation. It is solely for educational purposes.

thanks for the analysis!